Strategic Bundling, the Antidote to Modular Complexity

Gentlemen, I know of only two ways to make money, bundling and unbundling. - Jim Barksdale

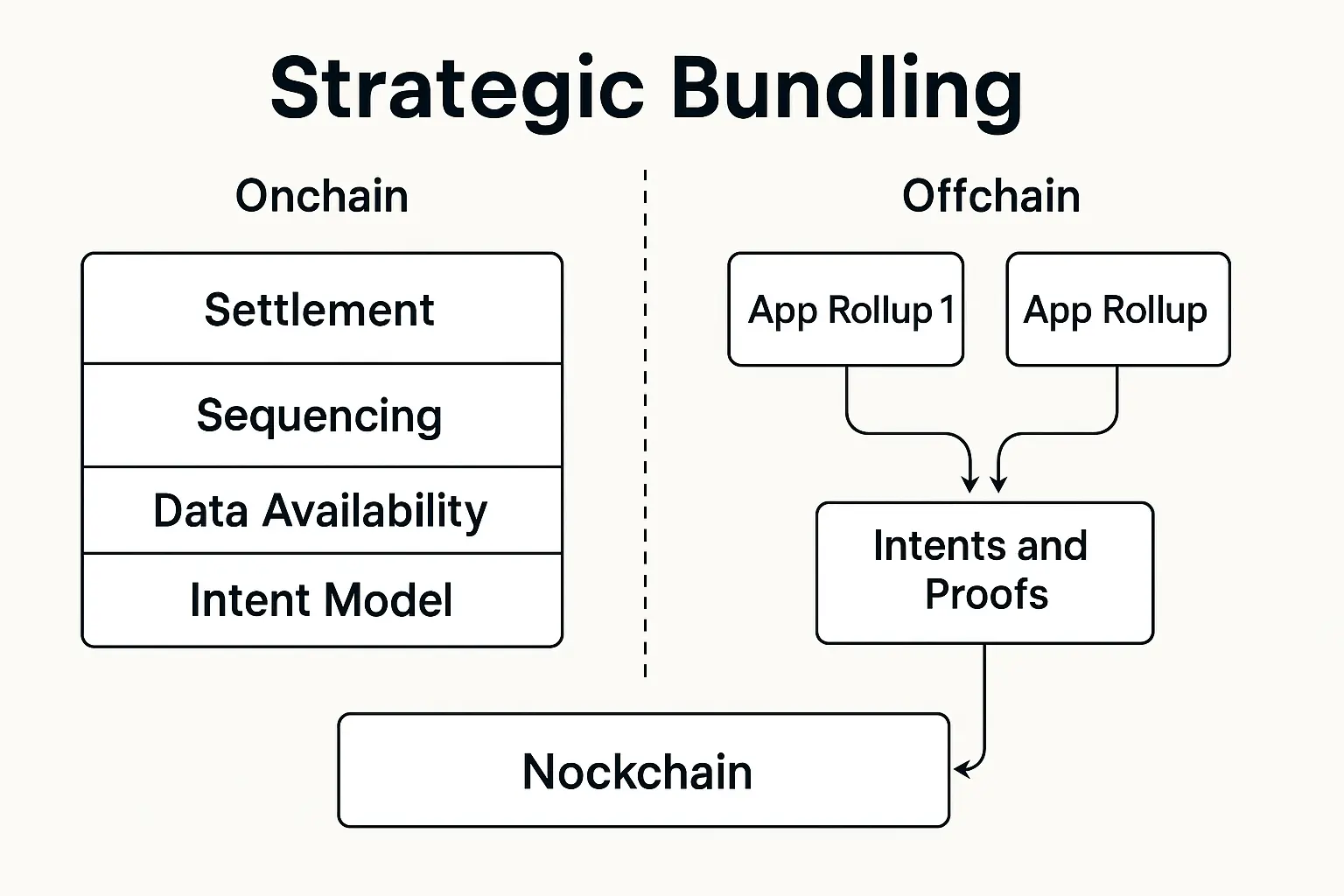

Strategic Bundling reunifies settlement, sequencing, and data-availability into one market while off‑loading execution to app-rollups.

The last decade of blockchain design has been a pendulum swinging between monolithic systems that centralize as they scale and modular stacks that fracture as they grow. Monoliths keep every function—settlement, sequencing, data availability and execution—inside a single chain, so hardware requirements rise linearly with throughput and exclude most validators. Modular architectures split those same functions across multiple networks, lifting raw capacity but introducing multiple tokens, overlapping fees, fragmented liquidity, and a maze of developer choices that erode user experience. Nockchain proposes a middle path of Strategic Bundling: settlement, sequencing, data availability and an intent‑native note model remain onchain, while execution and heavy computation move offchain to app-rollups that return succinct proofs. This approach bounds onchain node workloads without recreating the coordination problems and UX pitfalls of full modularity.

Strategic Bundling resolves the economic coordination failures that plague modular stacks. When execution, data availability and settlement live on their own chains, each layer has separate tokens and fees, splitting liquidity pools, fragmenting network effects, and complicating user experience. Nockchain bundles the core functions of settlement, sequencing, data-availability, and intent composition into a single market denominated in $NOCK: transactions are paid for strictly by weight, and the blob store provides data-availability for large amounts of temporary data. The whole stack generates one revenue stream: value created by applications automatically flows to the token that pays miners to secure the chain, and users interact with one network and token instead of multiple. Network effects center around $NOCK, because every asset ultimately settles into notes on the base layer, so cross‑rollup trades clear without external bridges or synthetic wrappers.

All data and assets live within notes onchain. Notes may declare intents, conditions under which they may be spent. App-rollup operators or onchain intent-solvers may execute these intents in batches, providing a proof that all conditions in the batch were satisfied. A cornerstone of Nockchain’s design is its native support for composability of intents across applications. Multiple intents from independent offchain apps are aggregated into batched proofs with explicit dependency chains, ensuring atomicity: either all dependent intents within a combined proof succeed, or none do. Nockchain’s settlement layer verifies aggregated proofs atomically, allowing large batches of notes to be spent or modified simultaneously with minimal onchain execution.

Developers write their state machines in Jock or Hoon, compile to Nock and let the framework handle persistence, networking and proof generation. Developers no longer optimize gas at every line of code; cost is dominated by the size of the proof and the bytes they store on chain. Users interact with a single wallet and never wonder which network holds the deepest liquidity or lowest fees.

By strategically bundling the core economic functions of a distributed ledger while pushing execution offchain, Nockchain keeps the scaling benefits of modularity and the network‑effect strengths of monoliths. The network remains decentralised, miners have sustainable long-term revenue, and the user experience remains simple.

This article is not investment advice. Zorp does not issue $NOCK, does not create a market in $NOCK or guarantee that any such market will be made.